There’s a simple rule about money and savings that should be taught to every kid in grade school.

It’s known as the 50 30 20 rule and it governs some simple laws on how to manage your money.

OK, that might not sound like something you teach grade school kids, but I wish someone had taught me a lot sooner.

Knowing the 50 30 20 rule lays the foundations for a healthy attitude to saving, spending, and what you spend your money on.

And, that’s good not just for the kid who learned about this great budgeting method, but for the whole economy.

Save with every purchase

Sometimes all you have to do is be at the right place and at the right time. Purchase from your favorite shops and get rewarded points with every purchase you make. Redeem points to Gift cards and/or Crypto!

So, what is the 50/30/20 rule and where did it come from?

The real appeal of the 50/30/20 rule is the simplicity with which it can help you divide your income into segments to make saving easy and less of a hassle.

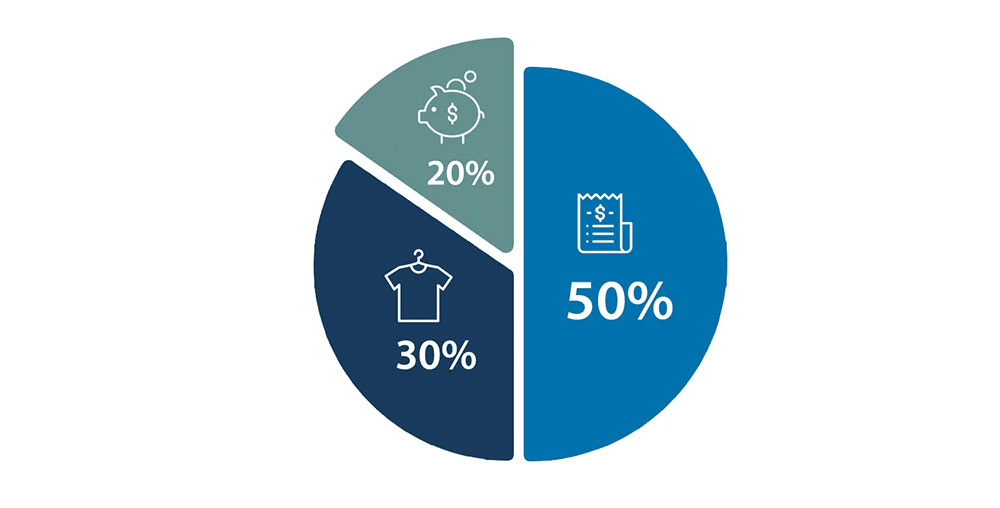

According to the rule, your income – after tax – should be divided proportionally in the following manner:

- 50% for needs

- 30% for wants

- 20% for savings and debt repayment

The origin of the rule can be traced back to a book – and 20 years of research – published in 2005, “All Your Worth: The Ultimate Lifetime Money Plan,” written by US Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi.

Budgeting

The rule centers on the premise of budgeting your money effectively, simply, and sustainably in a 3-tier system, and is based on your after tax income.

For example. If your monthly after tax income is $2,000 it should be divided as follows to make it work most effectively; $1,000 for needs, $600 for wants, and $400 for savings or debt payments (we’ll get to what needs, wants, and savings are in a moment).

How to apply the 50/30/20 rule: a step-by-step guide

If you can find a balance between your income and your expenditure, whatever is left over can be used to top up your savings account or to make repayments on debts that need urgent attention.

Using only three major categories the rule lets you simplify the often frustrating task of even coming close to budgeting your income better.

If you know just how much you can spend on each category – 50% for needs, 30% for wants, and 20% for savings and debt repayment – sticking within those parameters will greatly improve your chances of staying within your budget.

Let’s take a closer look at the 50 30 20 rule break.

50% for needs

Every month we have costs that won’t go away. Things that we can’t avoid, and essentials that we simply need to survive. Things like the following.

- Rent

- Energy bills

- Insurance

- Motoring and transport expenses

- Food and groceries

That’s why the 50 30 20 rule suggests you allocate 50% of your income after tax to cover these most important costs.

Don’t be confused between needs and wants. Needs are the things that you absolutely can’t do without. We’re not talking about restaurants, gym subscriptions, or your Netflix membership.

Examine your spending habits

If you find that you’re spending more than 50% on your needs, you’ll need to trim your budget in the wants and savings departments, and perhaps even adjust your lifestyle to fit your budget.

You may need a smaller apartment, a more efficient car, reduce energy spending, or learn how to budget better in the kitchen.

It doesn’t have to change your entire lifestyle, but if you’re spending more than your 50% on needs, something needs to be looked at.

Get some great tips on how to save money here

30% for wants

Next up for inspection is the 30% of your after tax income that you get to allocate for your ‘wants’.

But what does ‘wants’ really mean according to the 50 30 20 rule?

Think of wants as the icing on the cake of life. The non-essential things that we spend money on.

Sure, things like a meal out with family or friends might seem essential to our mental health, for maintaining relationships, or just for feeling good, but ask yourself could you live without such trimmings if you really had to?

Wants might cover such things as:

- Gym membership (we mentioned it earlier)

- Shopping for clothes

- Entertainment – TV/Music/Web subscriptions

- Luxury groceries

- Dining out

- Vacations

- Car upgrade

Save with every purchase

Sometimes all you have to do is be at the right place and at the right time. Purchase from your favorite shops and get rewarded points with every purchase you make. Redeem points to Gift cards and/or Crypto!

Just like managing your needs, if you are overspending on your wants, and not hitting your financial goals, you’re going to feel the negative trickle-down effects on your savings and debt payments.

NOTE: If you don’t know if something is a want or a need, ask yourself a simple question: “Can I live without this?” If you can, it’s a want.

Also, if you’re looking at the 50 30 20 rule and having problems deciding what’s a necessary purchase and what’s not, or if you just want some tips on how to stop spending, you might want to take a look at this helpful guide: ‘How to stop spending‘.

20% for savings

There’s a saying that goes, ‘Don’t save what’s left after spending, spend what’s left after saving.’

That might be a bit extreme – but not for everyone – so for now, at least until we get the hang of saving, it’s recommended that we put aside 20% for saving (and making necessary repayments).

This 20% should be allocated for savings and investments as a priority. This 20% should also be used to pay for outstanding or urgent debt repayments.

The experts recommend that we should all have an emergency fund of at least three months to tackly unforeseen circumstances.

If you have an outstanding loan or existing debt that needs urgent attention, your savings are there to meet those needs. However, if you have to delve into your savings fund it should be replenished as quickly as possible. (Regular loan repayments come under the ‘needs’ heading).

As we all know only too well, when an emergency comes calling, it’s usually followed in quick succession by a couple of others. That’s when an emergency fund shows its true value.

And don’t forget, making regular retirement contributions might seem like wasting money at the time, but the day will come when you’ll pat yourself on the back for not scraping on your retirement savings.

How important is saving?

The importance of saving – According to one report by Investopedia – Americans are not very good at saving having amassed $14.9 trillion in total debt, which includes $756 billion in credit card debt. As of January 2022, the personal saving rate in the US stood at a mere 6.4%.

Is it right for me?

The 50 30 20 rule is right for everyone, let there be no mistakes about that.

Some people take it so seriously that they set up their bank account in three categories, with one designated section for each of their needs wants and savings goals.

Save more than you would elsewhere

The Monetha app offers accumulative reward points with every purchase and big savings from your favourite shops.

If you want to get out of debt faster, know your spending thresholds, get a snapshot of your overall financial picture, or know exactly where your total monthly income is going, the 50 30 20 rule is for you.

The practicalities of the 50 30 20 rule

The beauty of the rule is its simplicity of application.

Know what your after-tax income is.

For freelancers that sum will be what you earn in any given month, minus business expenses and tax dues.

For anyone with a regular paycheck, take a look at your payslip and see the figure that winds up in your bank account at the end of the month. If deductions for things like health care insurance are subtracted automatically add them back into the equation.

What did you spend your money on?

It’s not a nice task, but you’ll need to do a total breakdown of your after tax income to understand where you spent your money in the last month. It’s not going to make for pretty reading, but you have to start somewhere, right?

Next, you’ll need to split your spending categories into three – needs, wants, and savings. Ok, that wasn’t so hard, was it? At least you’re now well on the way to managing your financial health properly.

Match your spending to the 50 30 20 rule

Once you’re at this stage, you’re well on your way to managing your finances in a more simple and manageable way.

There’s no point in having an excess amount of money in the bank but you’re still living a miserable life.

That’s why knowing where money is being spent or overspent once you receive your take-home income, will allow you to trim your expenditure on needs and allocate more money to wants and savings goals.

Of course, it all depends on your priorities. If you’re saving to retire, to upgrade your home, or get married, savings will be your main goal and money will need to be cut from the wants category.

By reducing your ‘wants’ spending, you’ll be able to meet your 20% savings goal far more easily.

Turn needs and wants into savings.

Before we start, you should know that I don’t have a magic wand. I can’t help you change your spending habits with a quick Abracadabra – I wish I could, but sorry…

But, now that you’ve analyzed your spending, you know where your needs and wants money is going.

Next, you need to look a little closer at where that money is being spent and if there is any way to shave a little extra off your payments.

If you just look closely and shop around, there’s always a way to save a little extra.

If you have a large grocery bill every month, why not download the Monetha app and start saving immediately?

Monetha is a rewards program with hundreds of online stores as partners. Once you sign up – you even earn for signing up – you can start shopping and getting great discounts while earning cumulative points from Monetha with every purchase.

The Monetha points can then be exchanged for gift cards – for extra savings – or swapped for cryptocurrency – for extra investment/savings – or even used to donate to deserving charities – for good karma.

Hundreds of ways to reduce your monthly expenses

If you want to improve your personal finance situation, there are literally hundreds of ways to do it.

As part of your budgeting methods, the 50 30 20 rule will help you learn to put your spending under a microscope and evaluate if there’s a better way of doing things and increasing your disposable income.

You could download a budgeting app, sign up for store loyalty cards that offer deals and discounts for regular shoppers, switch to a cash back credit or debit card, or simply use comparison websites to check prices before you buy.

smart shopping journey starts with monetha

The days of shopping without being rewarded are over. Earn from every purchase you make at your favourite online shops. Join today!

Tips to help manage your monthly income and living expenses

- Join a rewards program

- Switch to a cashback debit card

- Use comparison sites

- Use a budgeting app

- Get a better smartphone deal

- Use price comparison sites

- Are you paying the lowest price for home energy

- Use a smart meter in the home

- Check if you’re getting the tax relief that you’re entitled to

- Use loyalty cards for cheaper groceries

- Walk or cycle instead of driving

- Turn down the home heating

In fact, there are many ways to save small amounts that all add up to bigger savings in the long run.

As we said already, be prepared to put your finances under the microscope and make changes for the better wherever possible and make the 50 30 20 rule work for you too.

Finally, there’s a lot of technical support out there to help you find ways to save money. There’s a huge array of apps and programs designed to find ways of improving your ability to budget better. Monetha has compiled a list of some of the most helpful apps to save you money.